Understanding the Impact of the Federal Reserve Prime Rate on the Macroeconomy

The Federal Reserve Prime Rate is a key factor that affects the macroeconomy and has a significant impact on various sectors. As a neutral, formal, trustworthy, friendly, and witty writer, let’s dive into the current state of the prime rate and its implications.

The prime rate is the interest rate that commercial banks charge their most creditworthy customers. It serves as a benchmark for many other interest rates in the economy, such as mortgage rates, credit card rates, and small business loans.

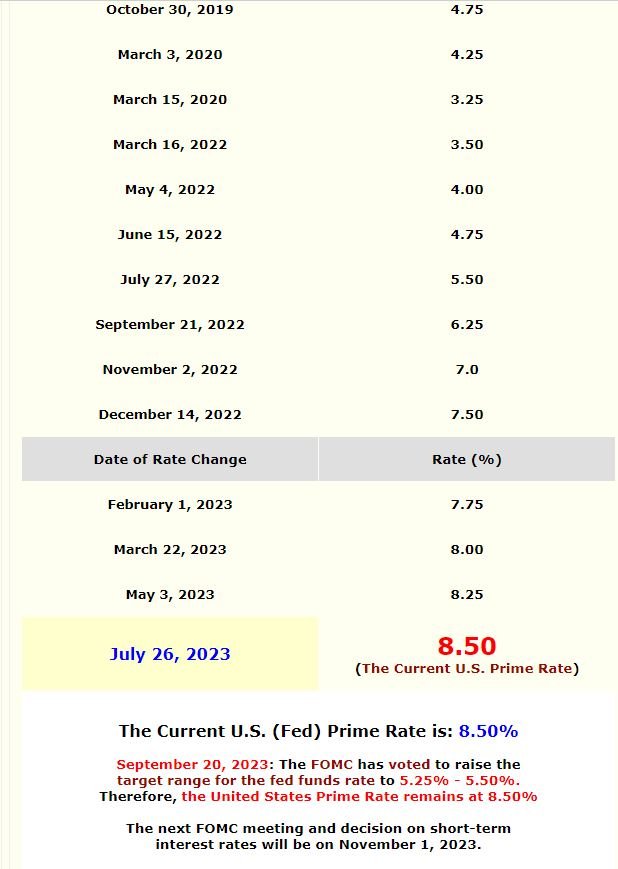

Currently, the Federal Reserve Prime Rate stands at 8.50% as of November 1, 2023. The next FOMC meeting and decision on short-term interest rates will be on December 13, 2023. This rate is determined by the Federal Reserve, which is the central bank of the United States. The Federal Reserve uses the prime rate as a tool to manage monetary policy and control inflation.

When the prime rate is lowered, borrowing becomes cheaper, encouraging businesses and individuals to take out loans. This stimulates economic activity, as it becomes easier for businesses to invest and expand. Additionally, lower interest rates make it more affordable for consumers to make large purchases, such as homes or cars.

Conversely, when the prime rate is raised, borrowing becomes more expensive. This can slow down economic growth, as businesses and individuals may be less willing to take on debt. Higher interest rates can also reduce consumer spending, as it becomes more costly to borrow for large purchases.

The prime rate also has an impact on the stock market. When interest rates are low, investors may be more inclined to invest in stocks, as they offer higher potential returns compared to fixed-income investments. On the other hand, when interest rates rise, investors may shift their focus towards fixed-income investments, which offer a more stable income stream.

Federal Reserve Prime Rate plays a crucial role in shaping the macroeconomy. Its movements influence borrowing costs, consumer spending, business investment, and even the stock market. As the prime rate changes, it’s important to stay informed about its implications and how it may impact your financial decisions.

Prime Rates